Case Study: Implementation of Credit Risk Engine

Client

Wholesale Bank based in Bahrain having exposures across carious asset classes such as Sovereign, Banks and Corporates

Broad Scope

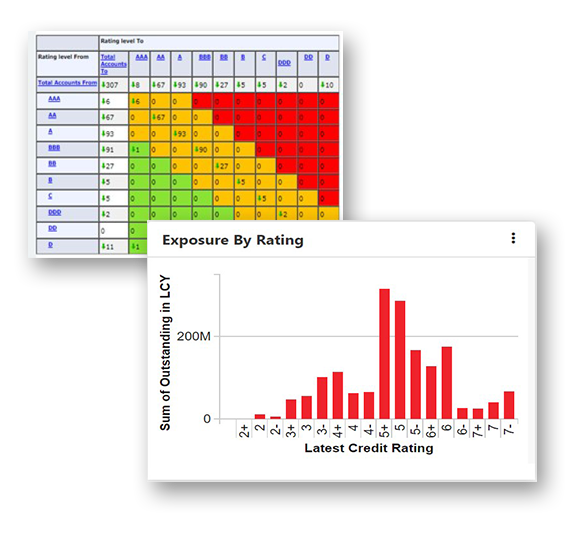

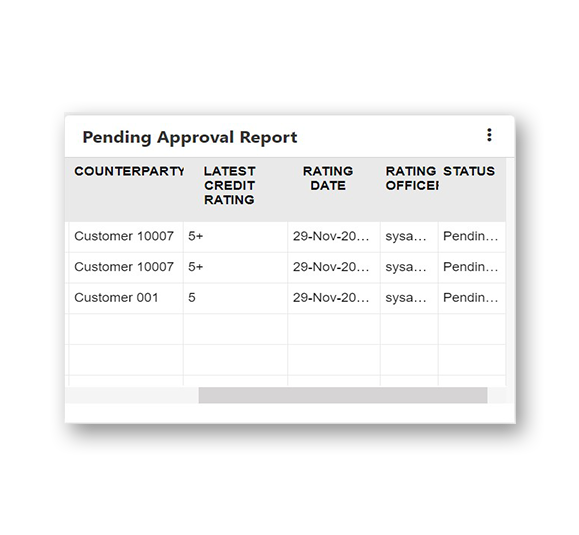

The Bank wanted to implement Credit Risk Rating Model within their credit approval process for existing & new customers related to Banking and Corporate exposures asset class. The scope included development of Master Rating Scale, development of Financial Institutions & Corporate Rating Models, Installation of models on Credit Risk Engine under RiskCube platform and configuration of approval process workflow and comprehensive MIS with rating reports, complete history of customer data and their internal / external risk ratings, rating migrations, process monitoring reports, rating review calendars, rating wise portfolio and industry reports; all these at customer & portfolio level covering all asset classes.

Our Approach & Solution

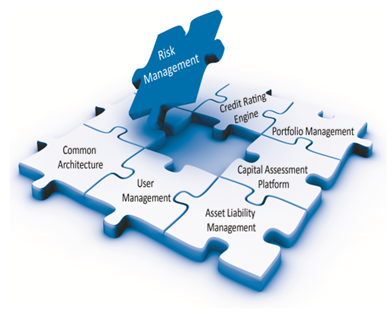

To achieve project objectives we have developed two separate Financial Institutions and Corporate Credit Risk Rating Models for the Bank. The Rating Models were developed in compliance with guidelines mentioned in Basel II accord and related developments. Implementation of these models was done by configuring these models in Credit Risk Engine product module within RiskCube platform. All supporting information like Master Rating Scale, Adjustments, model and judgement over-rides, User defined customer and model applicability criteria was configured in Credit Risk Engine.

During start of the initiative, we developed a master rating scale for the Bank. As next step, FI and Corporate Rating Models were developed covering variety of quantitative (financial) & qualitative factors covering business, financial, industry, company and management specific factors. These models were thoroughly tested and calibrated in coordination with expert Business and Risk Teams and using customer data from existing portfolio.

Our flexible product platform ensured all credit risk evaluation rules and parameters were successfully configured and parametrized through easy-to-navigate front end screens. We were able to achieve complete and accurate automation of the credit risk evaluation and rating process to enhance efficiency and effectiveness of existing credit approval process. The Bank was able to automate and successfully capture all input, intermediate and final data fields for all customers, including historical data and archival process, leading to creation of critical and risk information for Risk Data Mart.

A thorough UAT was conducted UAT was successfully conducted by Business, Credit and Risk Management teams Risk Management department covering all process, accuracy of output and MIS and for consistency and robustness of the platform. The results were fully reconciled to the General Ledger and Balance sheet information. The project was then successfully moved to production environment for day to day use and conduct of Credit Risk Ratings.

Business benefits

Significant business benefits were achieved post project implementation. Apart from implementing global benchmark best practices, the Bank was successful in complying with latest Basel guidelines related Rating model design, methodology, processes and operating environment From a rudimentary basic judgmental process for credit evaluation, the Bank successfully moved to a rating model based credit decision making process in compliance with global benchmark and in line with leading global and regional institutions.

Additionally, Credit Risk Engine within RiskCube platform has helped the Bank successfully enhance its Risk Data Mart which has become the repository of critical customer and deal level risk data for conduct of future risk analytics and model validation exercise.