Case Study: Implementation of Liquidity & ALM System

Client

Commercial Bank based in the Middle East having exposures across various asset and Liability classes such as Placements, Corporate Finance, Securities and Deposits

Broad Scope

As part of the Strategic Risk Transformation Program, the Bank wanted to implement best practices in Asset Liability Management manage short, medium and long term liquidity and interest rate risk for senior management and ALCO reporting. The client desired to implement daily and monthly reporting cycles for liquidity and interest rate risk.

Our Approach & Solution

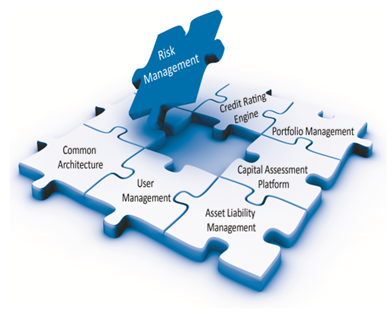

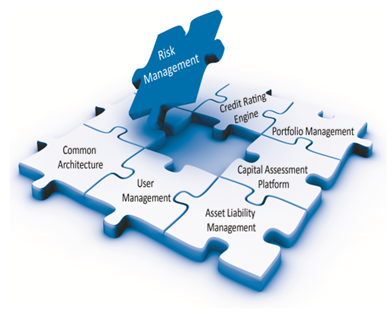

To achieve Client objectives we have implemented the Asset Liability Management (ALM) product module as part of RiskCube Platform Implementation.

During start of the initiative, we helped the client prepare a comprehensive roadmap to identify various activities for ALM and Liquidity Risk Implementation. Data and process mapping was conducted with Core Banking System for required activities, data and business processes. This led to significant improvement and optimization of existing business processes and implementation of new processes within the Bank in order to rectify and improve existing core banking processes to get required information. We were able to achieve desired integration with core banking system without need for any manual intervention or process.

Our flexible product platform ensured accurate configuration of business rules for cash flow generation and mapping for all on and off balance sheet assets and liabilities. These were parametrized through easy-to-navigate front end screens without resorting to any hard coding or change in core RiskCube product. We were able to achieve 100% automation for generating more than 50 daily and monthly reports for liquidity and interest rate risk covering cash flow projections, statutory liquidity reports, interest rate sensitivity reports, Net Currency overnight position report, modified duration and Price Value Basis Point reports at consolidated group level and individual branch entity level. The reports were also produced for each currency making it a reporting pack of more than 200 reports. The Product was implemented with further capability to generate additional user defined reports for multiple user defined bucketing configurations and drill down capability at deal level for user defined reports through capital reporting cube with deal level drill down capability.

A thorough UAT was successfully conducted by Bank’s internal Risk Management department for consistency and accuracy of results. 100% reconciliation to General ledger and Trial Balance was achieved during this implementation post which the project was successfully signed off for production movement and Go-Live transition.

Business benefits

Significant business benefits were achieved post project implementation. Apart from implementing global benchmark best practices, the Bank was able to engage in active liquidity and interest rate risk management. It was able to accurately identify short – medium term liquidity position with possible future gaps to ensure active fund management. Regarding Interest rate risk, it was able to accurate assess impact of interest rate movements on its rate sensitive portfolio and based on economic US Dollar value. The Bank has been able to move to daily assessment of liquidity and interest rate risk for the 1st time with greater insight into pattern and impact of such movement.

Additionally, all data and reports during RiskCube implementation was reconciled 100% to the to the General Ledger covering complete Trial Balance and Balance Sheet at customer deal and individual GL level. This has helped the client to successfully create a strong foundation for Risk Data Mart which has become the repository of comprehensive risk data for conduct of future risk analytics.