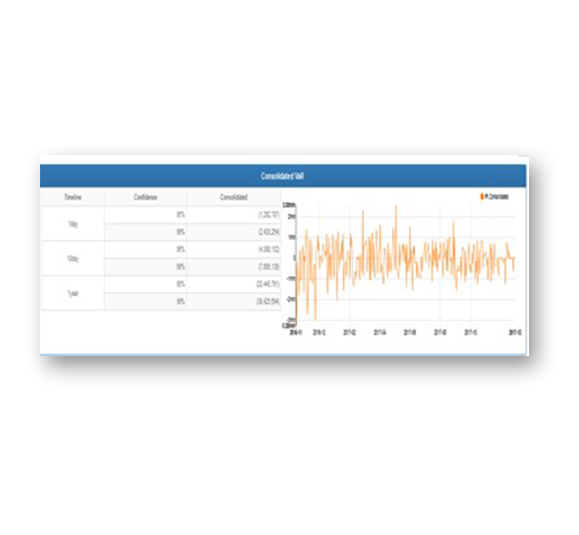

An integrated system to performs risk and return attribution of Equity, Fixed income and foreign exchange portfolios. It gives consolidated risk and return attribution with various drill-downs. The tool can be used for risk measurement and risk-reward analysis. Additional functionalities include pricing, volatility, basis risk management, VaR analysis, market risk limits management and comprehensive reporting.

© Copyright Avati Consulting Solutions 2022. All Rights Reserved.

Privacy Policy